social security tax limit 2022

The Social Security deduction is only allowed for a married couple filing a joint return not. Other important 2022 Social Security information is as follows.

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

To get the biggest checks possible you need to earn at least Social Securitys maximum taxable income for at least 35 years.

. This amount is also commonly referred to as the taxable maximum. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your Social Security benefits in 2021 according to the Social Security Administration. The maximum Social Security tax per worker will be 18228or a maximum 9114 withheld from a highly paid employees 2022 paycheck.

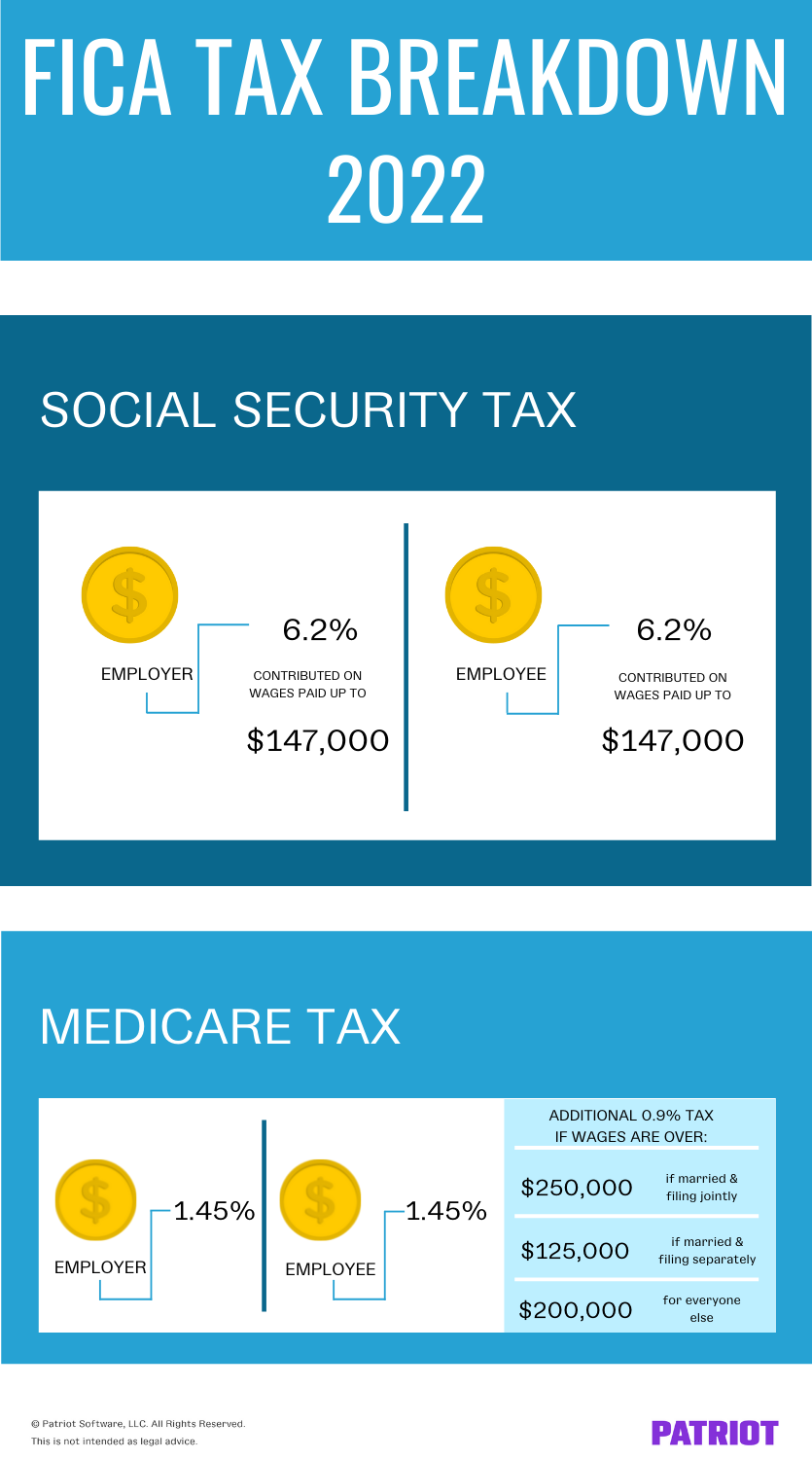

The wage base limit is the maximum wage thats subject to the tax for that year. Read More at AARP. Workers and their employers each pay a 62 Social Security tax.

This income limit changes from year to year but for 2022 it is 19560. Thankfully social security benefit statements can be used to help Americans complete their tax returns. Or Publication 51 for agricultural employers.

The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2022 will be 9114. The simplest answer is yes. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

Most people who exclusively receive Social Security benefits are not subject to federal income tax. Social Security benefits include monthly retirement survivor and disability benefits. For earnings in 2022.

Social Security income is generally taxable at the federal level though whether or. Theres no wage base limit for Medicare tax. The Social Security wage base is 147000 for employers and employees increasing from 142800 in 2021.

Quarter of 2020 through the third quarter of 2021 Social Security and Supplemental Security Income SSI beneficiaries will receive a 59 percent COLA for 2022. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2022 will be 9114.

In 2022 the Social Security tax rate is 62 for employers and employees unchanged from 2021. 5 rows For 2022 the maximum limit on earnings for withholding of Social Security old-age. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000 up from the. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021. May 10 2022 440 PM 9 min read.

For funds earned this year the tax maximum is 147000. Self-employed people must pay. Prior to reaching full retirement age you will be able to earn up to 19560 in 2022.

The Social Security Administration wont always ask the right questions to determine if youre over the limit when they process your application. We call this annual limit the contribution and benefit base. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits. The average monthly Social Security payout for a retired worker in 2022 is 1658 or 19896 annually. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

Every January social security claimants are notified of how much they received in benefits during the previous year. IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. After that 1 will be deducted from your payment for every 2.

How Do Americans Who Claim Social Security Know If They Must Pay Tax. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021. A discussion on taxes and Social Security requires an article of its own.

They dont include supplemental security income payments which arent. For earnings in 2022 this base is 147000. In 2022 you can earn up to 19560 a year without it impacting your benefits.

That number goes up to 65 in 2021 before the full 100 in 2022. The limit changes year to year depending on the national average wage index. But there is technically no 10 years of work requirement you simply need to earn 40.

For earnings in 2022 this base is 147000. The federal tax on Social Security is designed in such a way that many people do not pay any tax on their payments. From there youll have 1 in Social Security withheld for every.

To qualify for Social Security benefits youll need to earn 40 quarters of coverage. You can earn a maximum of four quarters per year which for most people means youll need to work for at least 10 years to qualify for retirement benefits. Social Security bases your benefit on your top 35 years of earnings.

You can find more reading on this topic in my. In 2021 employees were required to pay a 62 Social Security tax with their employer matching that payment on income of up to 142800. For money earned in 2022 the taxable maximum as it is also called is 147000.

This is the maximum amount of Social Security tax an employee will have withheld from their paycheck.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Sole Proprietorship Modern Games Understanding

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

Social Security This Simple Chart Shows How To Almost Double Your Benefits The Motley Fool Social Security Benefits Social Security Disability Retirement Benefits

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Have You Ever Wondered How The Tfsa Contribution Limits Work What Investment Options Are Available To You What Ar Investing Money Money Sense Finances Money

Nssf Tanzania Balance Check Kuangalia Salio Nssf Kwa Simu In 2022 Tanzania National Board Security Service

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is Social Security Tax Calculations Reporting More

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

2017 2018 And 2019 Calendar Year Hsa Contribution Limit And Hdhp Qualification For Individual Coverage And Family Contribution 2019 Calendar Yearly Calendar

1096 Transmittal Tax Forms 25 Pack Of 1096 Summary Laser Forms Compatible With Quickbooks And Accounting Software In 2022 Accounting Software Small Business Accounting Software Quickbooks

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Pin By Cma Community On Budget And Investment In 2022 Economics Lessons Finance Education Money Saving Plan